Are These Challenges Familiar?

- Dropping the ball on client deliverables

- Difficult clients becoming increasingly demanding

- Administrative tasks falling through the cracks

- Working longer hours but accomplishing less

- Feeling overwhelmed by the growing client list

- Wondering if you’re cut out for running your own practice

If you’re nodding your head, you’re not alone. Many bookkeepers and tax professionals struggle with these exact issues, especially as their client base grows.

The E-FLOW Framework provides bookkeeping and tax professionals with ready-to-use templates and practical examples to transform chaotic practices into streamlined operations. Our 30-day implementation roadmap breaks down exactly how to apply each component using tools you already have, without expensive software or complex training. Reach out today for personalized guidance on implementing E-FLOW in your unique practice.

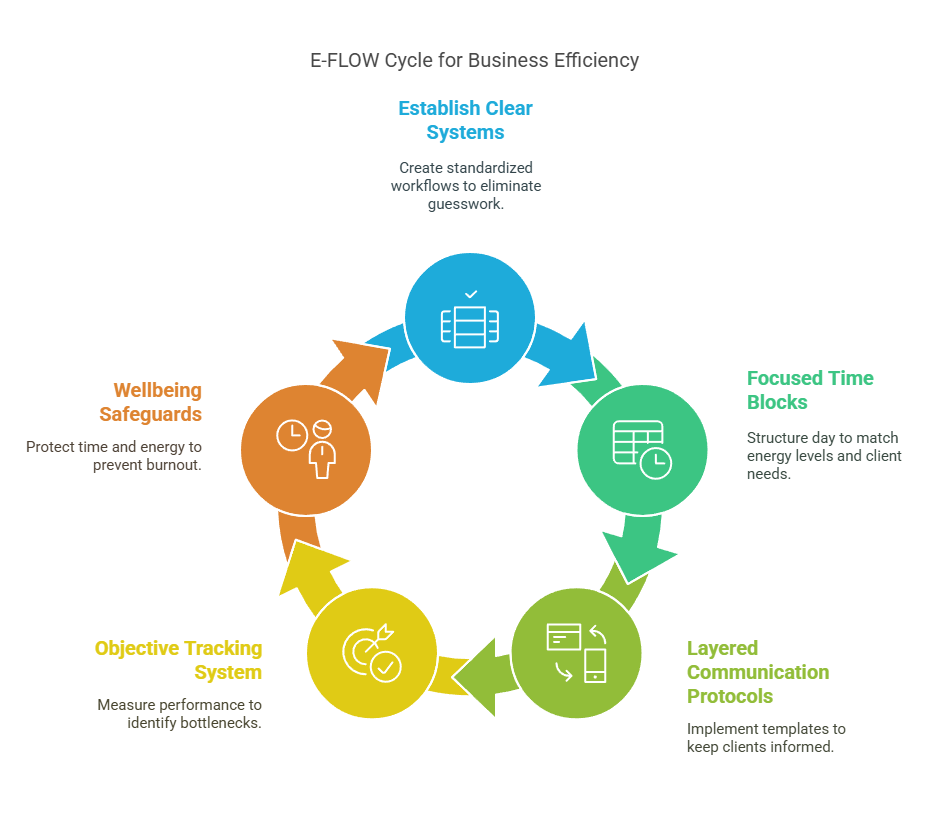

Introducing: The E-FLOW Framework

A proven system designed specifically for bookkeeping and tax practices that want to eliminate chaos, improve client satisfaction, and reduce owner stress—without expensive software or complicated implementations.

- E – Establish Clear Systems

- F – Focused Time Blocks

- L – Layered Communication Protocol

- O – Objective Tracking System

- W – Well being safeguards

E – Establish Clear Systems

Stop reinventing the wheel with every client interaction

Tax Preparation Service Line:

- Client Intake System:

- Standardized intake forms capture all necessary information

- Required document checklists prevent back-and-forth

- Automatic folder creation ensures nothing gets lost

- Tax Deadline Management:

- Extension tracking prevents missed deadlines

- Document receipt confirmation eliminates uncertainty

- Stage tracking makes progress visible at a glance

Bookkeeping Service Line:

- Monthly Service Calendar:

- Recurring appointment schedules that maintain consistency

- Document receipt reminders that run automatically

- Customized month-end close procedures by client type

- Client Communication Protocol:

- Template-based updates that save hours of typing

- Scheduled review meetings that prevent emergencies

- Clear escalation processes for handling exceptions

F – Focused Time Blocks

Stop letting your calendar run your life

Tax Preparation Focus:

- Seasonal Scheduling:

- Dedicated preparation blocks during tax season

- Protected time for extension work

- Strategic planning sessions that prevent last-minute rushes

- Daily Work Structure:

- High-cognitive tasks when your mind is fresh

- Client communications batched for efficiency

- Review sessions that catch errors before they reach clients

Bookkeeping Focus:

- Monthly Cycle Structure:

- Previous month processing with clear start/end dates

- Financial statement preparation on a consistent schedule

- Client review meetings at optimal times in the month

- Weekly Work Structure:

- Client-specific days that create predictable workflows

- Protected payroll processing time that prevents errors

- Focused reconciliation sessions that improve accuracy

L – Layered Communication Protocols

Stop the email overwhelm and missed messages

Tax Client Communication:

- Status Update System:

- Automatic notifications that build client confidence

- Strategic updates that prevent check-in calls

- Clear completion processes with next steps

- Document Request Protocol:

- Comprehensive initial requests that get results

- Effective follow-up templates for missing items

- Final notification systems that protect you legally

Bookkeeping Client Communication:

- Regular Touchpoints:

- Month-start preparation messages that set expectations

- Mid-month updates that prevent surprises

- Month-end deliverables with actionable insights

- Issue Management:

- Problem categorization that speeds resolution

- Timeline commitments that satisfy clients

- Decision documentation that prevents disputes

O – Objective Tracking System

Stop guessing about your practice’s performance

Tax Service Metrics:

- Efficiency Measurements:

- Return completion tracking that optimizes scheduling

- Document turnaround monitoring that identifies bottlenecks

- Extension percentage analysis that improves next season

- Quality Control:

- Error rate reduction through systematic review

- Amendment request tracking that prevents repeats

- Review checklist implementation that ensures consistency

Bookkeeping Service Metrics:

- Timeliness Tracking:

- Month-end close monitoring that improves scheduling

- Response time metrics that enhance client satisfaction

- Deadline adherence tracking that builds your reputation

- Accuracy Metrics:

- Reconciliation discrepancy tracking that improves processes

- Adjustment frequency analysis that reveals training needs

- Client query monitoring that identifies process improvements

W – Wellbeing Safeguards

Stop sacrificing your health and sanity for your practice

Tax Season Protection:

- Capacity Management:

- Client intake limits that prevent overwhelm

- Complexity-based scheduling that accounts for reality

- Non-negotiable boundaries that preserve your energy

- Stress Mitigation:

- Strategic breaks that maintain peak performance

- Extension strategies that flatten the workload curve

- Recovery planning that prevents burnout

Bookkeeping Balance:

- Workload Distribution:

- Client spacing that prevents month-end chaos

- Difficulty-based pricing that compensates for effort

- Scope limitation documents that prevent creep

- Administrative Support:

- Task allocation frameworks that maximize help

- Clear handoff protocols that prevent drops

- Quality check systems that maintain standards

Implementation Without Overwhelm

Our simple implementation process helps you transform your practice in just 30 days using tools you already have:

Week 1: System Setup

- Create master tracking spreadsheets

- Set up client categorization

- Build your email template library

Week 2: Calendar & Communication

- Restructure your schedule with protective blocks

- Create your client communication calendar

- Set up automated reminders and follow-ups

Week 3: Admin Coordination

- Document clear responsibilities

- Create handoff procedures

- Establish quality control measures

Week 4: Client Transition

- Categorize clients by complexity and needs

- Implement new communication standards

- Review and optimize your new systems

Ready to Transform Your Practice?

Let Effortless Workflows help you implement the E-FLOW framework in your bookkeeping and tax practice.

Schedule a free 30-minute assessment call to discover:

- Which parts of the E-FLOW system will have the biggest impact on your practice

- How to implement these changes with minimal disruption

- What you can expect in terms of time savings and stress reduction