Introduction

Imagine trying to bake a cake using a recipe that combines two entirely different sets of ingredients for different dishes. The result? A confusing mess! This is exactly what happens when personal and business finances mix.

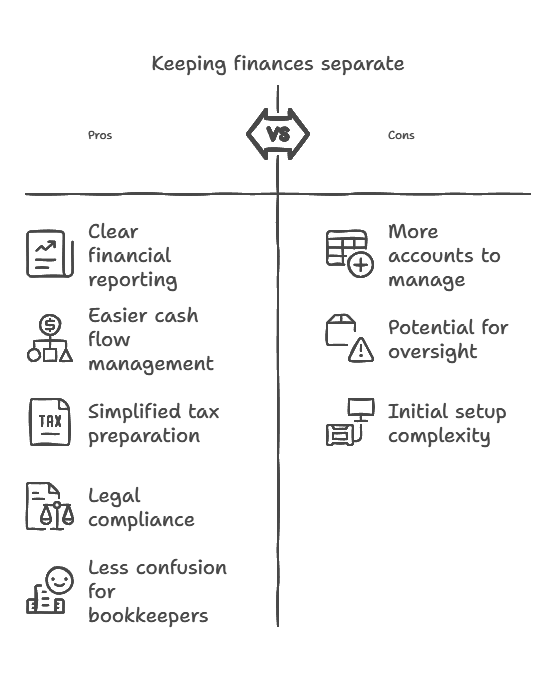

Whether you’re a solopreneur managing a side hustle or a seasoned business owner, keeping your personal and business transactions separate is critical. Commingling funds not only creates chaos in financial reporting but also complicates cash flow management, leads to tax and legal complications, and makes your bookkeeper’s job unnecessarily difficult. Let’s explore why this separation matters and how to achieve it.

The Core Reasons to Separate Personal and Business Finances

Legal Protection

For business owners, especially those with corporations or LLCs, separating finances ensures the legal distinction between personal and business assets. By keeping finances separate, you maintain the protective walls of limited liability, safeguarding your personal assets from business liabilities.

Think of your business as a castle with sturdy walls. When you mix personal and business finances, it’s like leaving the castle gates open, exposing everything inside to potential risks. If creditors or legal challenges arise, those blurred lines can be used against you.

Tax Benefits and Compliance

Mixing funds complicates tax filing and can lead to losing legitimate deductions. When personal and business expenses are intertwined, it becomes harder to identify eligible deductions, potentially leaving you with a higher tax bill.

This lack of clarity can also raise concerns during audits. Imagine handing over a shoebox filled with receipts, all mixed up between personal grocery shopping and business travel expenses. Not only does this increase your chances of being flagged, but it also results in unnecessary stress and potential penalties.

Professionalism and Credibility

Maintaining separate accounts projects professionalism to clients, investors, and financial institutions. When a client pays for your services, seeing the transaction go through your personal account can make them question your legitimacy. Similarly, investors and lenders are more likely to trust and support businesses that demonstrate financial discipline.

Running your business finances through personal accounts is akin to showing up to a board meeting in pajamas. It undermines the image of a well-organized, professional enterprise, making it harder to build trust and credibility.

Practical Benefits of Separation

Improved Financial Clarity

A clear separation of finances provides an accurate picture of your business’s health. It becomes easier to track income and expenses, which helps you make informed decisions about growth, investments, or cost-cutting measures.

Having this clarity is like driving with GPS. You always know where you are financially and can navigate challenges with precision rather than guessing your way through.

Better Budgeting and Cash Flow Management

Managing cash flow is significantly simpler when business expenses are handled separately. You can easily forecast and allocate funds without the confusion of personal transactions muddying the waters.

For instance, using personal savings to cover a business expense without proper documentation can lead to budgeting issues. Later, your records might show you have more money than you actually do — a recipe for financial chaos.

Enhanced Access to Business Financing

Clean, organized records are crucial when applying for loans or grants. Lenders want to see clear financial statements that reflect your business’s operations, not a mixture of personal expenses and business revenue. When your financials are a mess, it’s like submitting a smudged resume for a job application — confusing and unprofessional.

By building a separate credit history for your business, you increase your chances of securing financing and negotiating better terms with creditors.

Steps to Achieve Financial Separation

Open a Separate Business Bank Account

Start by opening a dedicated bank account for your business. This account becomes your business’s financial foundation, much like a dedicated storage locker where everything is neatly organized and easily accessible. Using a business credit card further simplifies expense tracking while offering benefits like rewards and improved credit history.

Set Up Proper Accounting Practices

Investing in bookkeeping software streamlines financial management, making it easier to track and reconcile transactions. Regular account reconciliation ensures your records remain accurate, giving you peace of mind.

Establish Clear Expense Policies

Developing and adhering to clear policies around expenses prevents personal withdrawals from business accounts. Document every transaction thoroughly to ensure clarity and accountability. Think of this system as a designated drawer for office supplies at home. You always know where everything is, and it’s easy to find what you need when you need it.

Common Challenges and How to Overcome Them

Balancing irregular income streams and unexpected expenses can be challenging. For instance, you might need to use a personal card for a business expense in a pinch. Address this by promptly reimbursing yourself from the business account and logging the transaction. Tools and technology can help you stay disciplined and ensure nothing slips through the cracks.

Planning ahead with a reserve fund for your personal needs can also help you avoid dipping into business accounts unnecessarily. Staying consistent with these habits fosters better financial discipline and stability.

Conclusion

Commingling business and personal funds might seem convenient in the short term, but it can lead to significant financial, legal, and operational issues. Treating your business as its own entity not only protects your personal finances but also sets the stage for long-term growth.

Think of it as planting a tree in the right soil. With the proper financial boundaries, your business will thrive and grow stronger over time, free from unnecessary complications.

Start today by opening a business bank account, setting up accounting software, or consulting a financial professional. With these steps, you’ll build a foundation for a healthy, sustainable business.

Follow me on Medium for more insights on running smooth, efficient operations and creating a stress-free financial environment for your business. Keep in touch to learn more about how we can help your business succeed.